The nation’s second-largest health insurer is shaking up its approach to paying doctors, putting a major investment behind the idea that spending more for better primary care can save money down the road.

Starting this summer, WellPoint Inc., which insures some 34 million Americans, will offer primary-care doctors a fee increase, typically of around 10%, with the possibility of additional payments that could boost what they get for treating the patients it covers by as much as 50%.

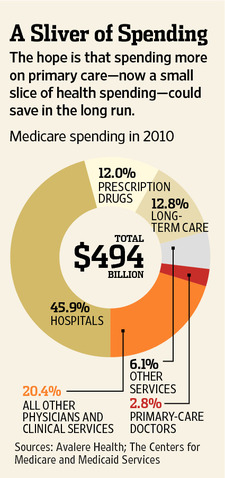

The new approach could pour an additional $1 billion or more into primary care, which WellPoint is betting will pay off in the form of fewer emergency-room visits and hospital stays.

“This will fundamentally change our relationship with primary-care physicians,” said Harlan Levine, WellPoint’s executive vice president of comprehensive health solutions.

Health-policy experts have long faulted the U.S. health-care system for placing too little value on traditional primary care, the front-line medical work that ranges from immunizing children to ensuring that diabetics get their blood-sugar tests. They also say that the current fee system, which sometimes fails to reward such services as planning outpatient care after a hospital stay, leads to bigger bills and worse results for patients.

Health-policy experts have long faulted the U.S. health-care system for placing too little value on traditional primary care, the front-line medical work that ranges from immunizing children to ensuring that diabetics get their blood-sugar tests. They also say that the current fee system, which sometimes fails to reward such services as planning outpatient care after a hospital stay, leads to bigger bills and worse results for patients.

Some doctors already are seeing some of the benefits that WellPoint is after. John Bender, a Fort Collins, Colo., physician whose practice is part of a pilot project involving WellPoint and six other insurers, cites a patient who was treated for a heart attack last February. She soon returned to the hospital, via an air-ambulance trip, for chest pain.

WellPoint flagged her case to Dr. Bender’s practice, Miramont Family Medicine. Doctors there took a closer look at her case and diagnosed an anxiety disorder. They referred her to their staff psychologist, started her on a low-fat diet and exercise regimen and controlled her blood pressure.

“She hasn’t visited the emergency room since,” said Dr. Bender, Miramont’s owner. “We create a tremendous amount of value.” As part of the pilot program, Miramont earned a roughly $100,000 bonus from the insurers last year, he said.

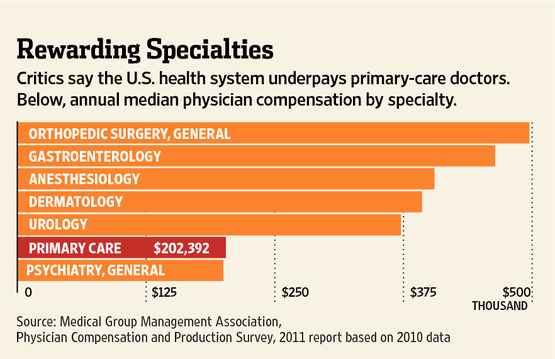

Primary-care doctors, such as pediatricians and family physicians, often make less than half of what top-paid specialists like orthopedic surgeons earn, and the idea of changing how they are paid has been around for years. Insurers and government agencies are experimenting with a variety of approaches. But WellPoint, with its network of about 100,000 primary-care doctors, could have a much broader influence.

Primary-care doctors, such as pediatricians and family physicians, often make less than half of what top-paid specialists like orthopedic surgeons earn, and the idea of changing how they are paid has been around for years. Insurers and government agencies are experimenting with a variety of approaches. But WellPoint, with its network of about 100,000 primary-care doctors, could have a much broader influence.

The “scale is so much bolder than things we’ve seen,” said Paul Ginsburg, president of the Center for Studying Health System Change, a Washington nonprofit group. “This isn’t an experiment.”

The impact could be amplified by another new effort, by health insurer Aetna Inc., which will start paying the 55,000 primary-care doctors across its network an extra fee—of $2 to $3 per patient per month—if their practices are certified as meeting certain standards for providing access for patients and coordinating their care.

In addition to its fee increase for visits, which will vary by market, WellPoint will offer primary-care doctors payments for services such as developing treatment plans for patients with chronic diseases. It says physicians will get a chance to make even more if they help pare the overall cost of patients’ care: a bonus amounting to as much as 20% to 30% of any savings they achieve.

WellPoint is also promising that it will give doctors data and staffing help to improve their practices. In return, those doctors will have to meet requirements including some form of 24-hour access for patients and keeping a registry to monitor chronic-disease care.

The insurer said the program, which will include only primary-care doctors who meet certain quality goals, could add as much as one or two percentage points to its primary-care spending, which now represents about 6% to 8% of the about $100 billion in claims it processes annually.

WellPoint officials said they think the company’s upfront investment in primary care could reduce its projected medical costs by as much as 20% by 2015 by improving overall patient health and reducing the need for costlier medical services.

Aetna, which insures 18.2 million people nationwide, didn’t give detailed projections but said its savings could amount to double the cost of its new program, which it will roll out over the year. Its new payments will go to primary-care doctors whose practices get certified as “patient-centered medical homes.” That generally means they must oversee all aspects of a patient’s health by providing longer hours of access, reminding patients when they are due for tests and coordinating care with specialists, among other things.

Elizabeth Curran, who oversees the insurer’s national network programs, said Aetna wants to “make the appropriate investment to help support” doctors as they seek to improve their practices.

Several early medical-home pilot projects have shown signs of improved quality and patient satisfaction, researchers said. Some regional insurers, such as Maryland-based CareFirst BlueCross BlueShield, have moved ahead with broader programs.

Still, “we have no strong evidence of cost savings yet,” at least based on short-term results published so far, said Meredith Rosenthal, a Harvard researcher who studies health-care payment.

WellPoint said its savings projections are based largely on its own data from medical-home pilot projects.

One big question is whether higher payments from any one insurer can change the way doctors work, given that many patients will still have more-traditional coverage. Bruce Bagley, medical director for quality improvement at the American Academy of Family Physicians, said he welcomed the new efforts. But, he said, “if you only have 10% of your practice that you’re getting paid extra for, that’s not enough to get your attention.”

Both Aetna and WellPoint said they wanted to move forward quickly, rather than waiting for other insurers to join their efforts. “We felt that we had an opportunity and a responsibility to do it,” said WellPoint’s Dr. Levine.

WellPoint pointed to its substantial market share of 15% to 46% of people with coverage in the 14 states it serves. It said it expects around 70% of the primary-care doctors in its network to join its new program by the end of 2014.

Aetna said around 30% of its network’s primary-care physicians are already eligible for its new bonuses, and the number is growing rapidly. Aetna is currently rolling out the program in Connecticut and New Jersey, and aims to implement it nationwide by the end of the year. In the two rollout states, the new payments should add around 15% to doctors’ revenue for their regular patients who are Aetna commercial-plan members, the company said.

Originally published in the January 27, 2012 edition of The Wall Street Journal.