By Jim Gaddis, MBA, FHIMSS. Co-Chair, Meaningful Use Center of Excellence, HIMSS. HIMformatics, LLC. 404-307-2126. [email protected]

Introduction: This is the first in a series of articles about the “Meaningful Use” of Electronic Health Records (EHR) in the physician practice setting. As part of the American Recovery and Reinvestment Act (ARRA) of 2009, the Federal Government has dedicated billions of dollars to incentivize the adoption of healthcare information technology nationwide. A significant portion of those funds are directed toward private physicians, and substantial incentive payments are available to physicians if they are willing to demonstrate the Meaningful Use (MU) of certified EHR technologies in their daily practice of medicine. This series of articles will focus on explaining MU, summarizing the rules, and navigating the reader to helpful websites and tools provided by HIMSS and other organizations.

The first question usually asked when discussing ARRA and MU is “What are the incentive payments and when can I get them?”. Because this is an incentive program, it is appropriate to focus on the incentives in addition to the eventual benefits that will be achieved by physicians and their patients from adopting these tools in the practice. The remainder of this article will be dedicated to an introduction of the payments and eligibility to receive them. Future articles will expand on what constitutes MU, the reporting requirements, certified EHR technology and other subjects.

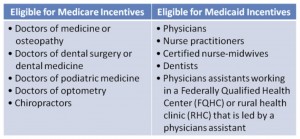

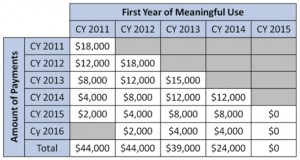

Medicare Program: There are 2 programs in place for Eligible Professionals (EP’s). The Medicare program is run by CMS and is geared toward EP’s that have a portion (or all) of their revenue coming from the Medicare Part A program and Medicare Advantage (MA) plans. These providers must have qualifying degrees (see Figure 1) and must practice less than 90% of their time in HIPAA Place of Service (POS) codes 23 (emergency room) or 21 (inpatient) settings. There are additional rules for MA providers. The incentive payments under this program can total up to $48,400 per EP if the provider qualifies for the early adopter bonus and practices in a Health Professional Shortage Area (HPSA). For providers not in a HPSA, the maximum incentive payments can total $44,000. In either case, the payments are spread over four years and there is only one payment per year on a decreasing scale (see Figure 2). If the adoption of certified EHR technology is delayed past 2012, eligibility for incentives will be reduced, until 2015 when eligibility is eliminated (see Figure 3). A useful tool for estimating ARRA Medicare Stimulus Payments for EP’s is available at http://www.himformatics.com/himss/final.htm. Use this interactive calculator to enter the specifics of a given practice and get an estimated Medicare stimulus payment schedule.

Medicaid Program: The Medicaid incentive program is run by the individual states and is voluntary, which means any given state may or may not participate. This program is geared toward EP’s that have a substantial portion (or all) of their patient encounters paid by Medicaid. These EP’s must meet a minimum threshold of 30% of their patient encounters paid by Medicaid if they are not Pediatricians. The threshold is 20% for Pediatricians, but the incentive payments are limited to 2/3rds of the maximum for EP’s qualifying under this lower threshold. Another qualified group is Physician Assistants (PA’s) and Nurse Midwives (CNMW) who practice predominantly in Federally Qualified Health Centers (FQHC’s) or Rural Health Clinics (RHC’s), where the clinic’s patient volume is at least 30% attributable to needy individuals. This group is eligible to receive the maximum Medicaid incentive payments. The Medicaid program is intended to reimburse the EP for a substantial portion of their costs of adopting the EHR, up to a limit of $63,750 for EP’s with 30% Medicaid patients, or $42,502 for Pediatricians using the 20% Medicaid threshold. Payments under this program are spread over 6 years and are 85% of actual or projected costs in each year, up to the specified limits. There are no incentive payments available for EP’s that adopt an EHR after 2016.

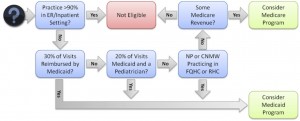

Which Program is right for Me? EP’s are allowed to participate in only one of these programs, and the program which will be most beneficial depends on the EP’s circumstances. The Medicaid program has higher maximum payments, and the payments are timed more in line with EHR costs. However, a state may not participate in this program, or the EP may not meet the minimum threshold of Medicaid encounters. The Medicare program requires only $25,000 – 30,000 of Medicare revenue to qualify for the maximum incentive payments, but the payments are spread more evenly over 4 years, and an EP participating in this program will lose any e-Prescribing (eRx) incentive payments currently being earned in that program. Figure 4 depicts a simplified decision process for choosing the best program, assuming the cost of the EHR system is greater than $52,000 over 6 years and there are no eRx payments currently being earned. HIMSS can provide additional information and tools to help in making this important determination.

Figure 1: Eligible Providers

Source: CMS

Figure 2: Medicare Incentive Payment Schedule

Source: CMS

Figure 3: the Cost of Waiting

Source: HIMformatics

Figure 4: Decision Process Under Simple Assumptions

Source: HIMformatics